目前,大部分资产定价的学术研究都聚焦于美国等发达国家的股票市场。中国股市与发达国家相比具有较大差异,系统地梳理和筛选哪些因子在中国有效,是国内外投资者都感兴趣的研究课题。Hou, Qiao, and Zhang (2019) 基于A股的交易数据、会计指标和分析师预测数据,构建了426个因子,并探测和筛选哪些因子能够有效预测中国股市收益率。

Using data on stock trading, financial statements, and analyst forecasts from 2000 to 2018, Hou, Qiao,and Zhang(2019)construct 426 anomalies in China’s A-share stock market.

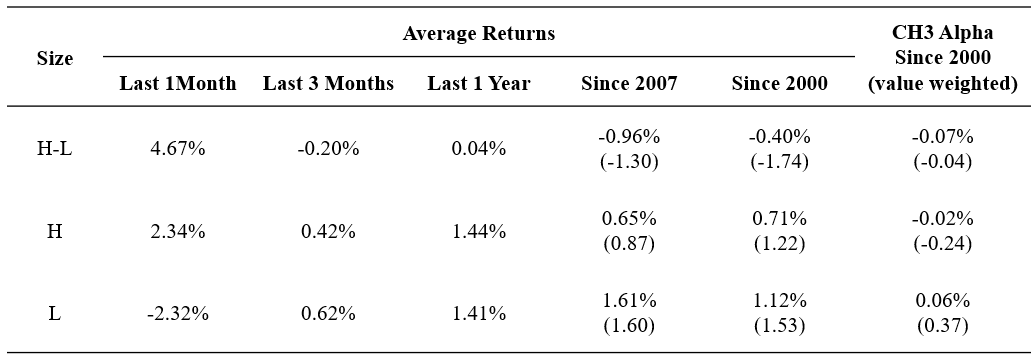

规模-Size

Value-Weighted Return (Report date:2019/10/30)

Data:https://xyfintech.pbcsf.tsinghua.edu.cn/uploadfile/2019/1216/20191216060437580.xlsx

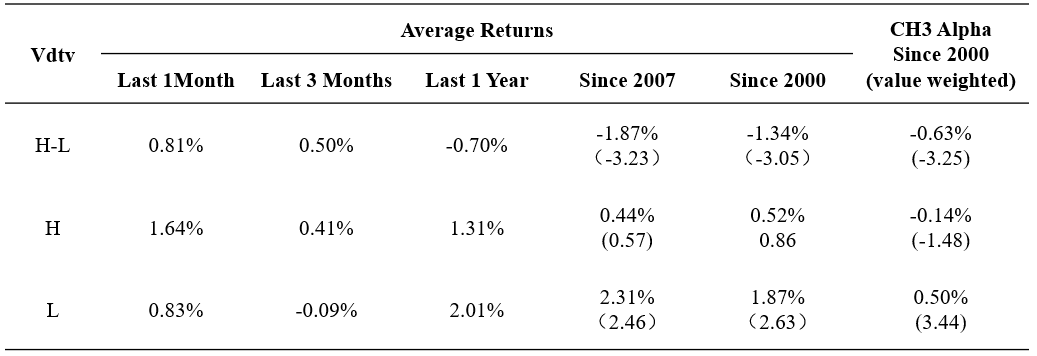

流动性-Liquidity

Value-Weighted Return (Report date:2019/10/30)

价值-Value

Value-Weighted Return (Report date:2019/10/30)

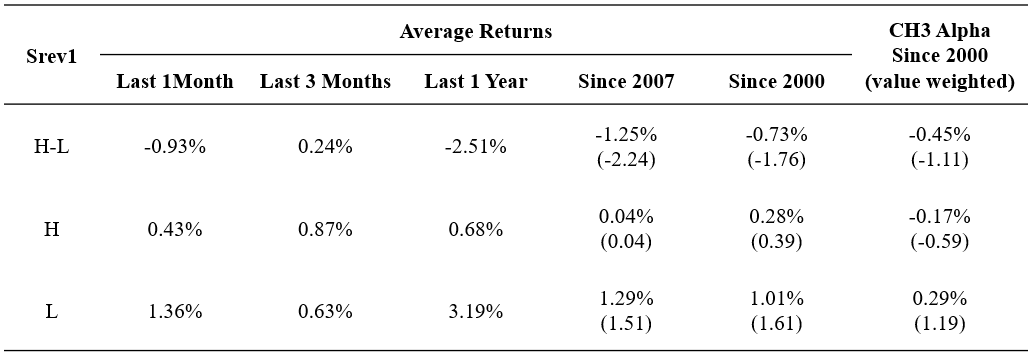

反转-Reversal

Value-Weighted Return (Report date:2019/10/30)

波动率-Volatility

Value-Weighted Return (Report date:2019/10/30)

Data : https://xyfintech.pbcsf.tsinghua.edu.cn/uploadfile/2019/1216/20191216060618728.xlsx

* 研究结果来自论文Kewei Hou, Fang Qiao, and Xiaoyan Zhang(2019), Finding Anomalies in China.

* Detailed Results can be seen in the working paper: Kewei Hou, Fang Qiao, and Xiaoyan Zhang(2019), Finding Anomalies in China.

* 数据仅用于学术研究,详情请邮件联系:xinyuanfintech@pbcsf.tsinghua.edu.cn

* Please contact us through xinyuanfintech@pbcsf.tsinghua.edu.cn for more information